UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

OMNICOM GROUP INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

2017 Annual Meeting of Shareholders

Proxy Statement

May 25, 2017 at 10:00 a.m. Central Daylight Time

DDB Chicago200 East Randolph StreetChicago, IL 60601

Proxy Statement 2020 June 9, 2020 at 10:00 a.m. Eastern Daylight Time ICON International Shareholders may also attend online at

|

A Letter from theOmnicom’s Lead Independent Director

To My Fellow Shareholders:

It is a great honorI would like to serve as Omnicom’s Lead Independent Director.start by acknowledging the difficult times that our society, shareholders, clients, and the Omnicom family are facing due to the COVID-19 pandemic. During this period, we have been focused first and foremost on ensuring the safety and well-being of our people, while continuing to support our clients and protect our business. Our Board is focused on the oversight of Omnicom’sand management team have been actively monitoring and protecting your interests. We believe that Omnicom’s commitmentresponding to the highest standards of corporate governance drives successCOVID-19 pandemic, and builds sustainable, long-term value for shareholders. 2016 was an excellent year for Omnicomwhile it is too early to understand its full impact on our operations and financial performance, we are confident that we have the right resources in place to weather these challenging times. I encourage you to referread the annual letter to the lettershareholders from John Wren, our PresidentChairman and Chief Executive Officer, whichJohn Wren, that addresses the steps we have taken in response to COVID-19. The letter is available on Omnicom’sour website at http://investor.omnicomgroup.com,investor.omnicomgroup.com.

In light of public health considerations, we have decided to learn more about the success of our company.

I would like to take this opportunity to provide you with an update on our continued progress on key initiatives.

Board Refreshment

Omnicom’s commitment to board refreshment is central to preserving director independence and 2016 washold a year of robust refreshment. Once our mandatory retirement age policy becomes effective December 31, 2017, Directors reaching the age of 75 will not stand for re-election. To ensure a smooth transition, two of our long-serving Board members stepped down in 2016 and an additional long-serving Board member, Mr. Michael A. Henning, will not stand for re-election at our 2017“hybrid” Annual Meeting of Shareholders. The Board is gratefulShareholders this year so that shareholders have the opportunity to Mr. Henning for his leadershipattend the Annual Meeting online via live audio webcast at www.virtualshareholdermeeting.com/OMC2020. Additional details on how to participate are included in the Proxy Statement.

2019 In Review:

Our focus and thanks him for his manypriorities have largely shifted in recent weeks due to the ongoing COVID-19 pandemic. We are fortunate that after several years of dedicated service.

Board refreshment, our Board and management team have strengthened Omnicom’s governance. The Board regularly evaluates directordiversity of perspectives and range of skill sets to ensure the optimal combination of expertise is represented on the Board. Over the past year, our Board has been keenly focused on the recruitment of exceptional director candidates to replace departing directors. The Board undertook a deliberate skills analysis of the directors stepping down from the Board, asthat we now have will serve us well as those who will remain,we respond to the current crisis and determined that the first priority was to focus on director candidates whose skills and experience not only enhance the Board, but also make them highly qualified to serve on our Audit Committee.

Two new independent directors, Deborah J. Kissire and Valerie M. Williams, joined the Board and our Audit Committee in 2016. Ms. Kissire is a former Vice Chair and Regional Managing Partner, member of the Americas Executive Board and member of the Global Practice Group of EY. Ms. Williams is a former Southwest Assurance Managing Partner for EY with over 35 years of public company audit experience. Each of Mses. Kissire and Williams possess business acumen, leadership skills and accounting expertise that will be a valuable assetkey to the effective oversight of Omnicom’s Board and Audit Committee. The Board is actively overseeinglong-term strategy. Moving forward, we will continue to adhere to solid corporate governance standards that support the recruitment of additional directors and has been working with an outside search firm to assist in identifying qualified candidates.company’s value-creation strategy.

Long-Standing Shareholder Engagement Program Remains a Priority.

EngagingMaintaining an open dialogue through engagement with our largest shareholders is another one of my top priorities and is alsoremains a focuspriority for the entire Board. I have had the pleasure of speaking with many of our largest shareholders about a variety of matters, including board leadership and composition, board refreshment, succession planning, executive compensation, sustainability, and diversity and inclusion. This past year, we reached out to more than two-thirdsshareholders holding 68% of our shareholdersoutstanding shares and we spoke to every shareholder who accepted our invitation to talk.for engagement. In these conversations, we discussed a variety of topics including board leadership and composition, the alignment of director skills with Omnicom’s strategy, succession planning, diversity and inclusion, corporate culture, executive compensation, and sustainability. We strive to maintain an open dialogue with our shareholders and believe investor input enablesvalue the Board to more effectively evaluate our governance practices. The constructive feedback we receive from shareholdersreceived during these engagements, which is shared with and discussed by the full Board on a regular basis.basis, and we factor this shareholder input into our evolving governance practices.

2 Our Board is Highly Engaged, Possesses a Wide Range of Skills and Experiences, and Continues to Focus on Refreshment. Proxy Statement 2017Omnicom’s Board is comprised of highly skilled directors with the collective experience and perspectives that together generate strong and effective oversight. This balanced and diverse mix of directors serving on Omnicom’s Board is a result of our ongoing refreshment efforts. Two long-serving directors will not be standing for re-election at this year’s Annual Meeting due to our director retirement policy. As a result, we again conducted a formal analysis of Shareholders

Tabledirector skill sets, and believe that we continue to have the optimal mix of Contentsdirectors in place to align with Omnicom’s key strategic priorities and critical areas of oversight, including strategic planning, industry experience, finance and accounting, risk management and controls, talent management, and technology.

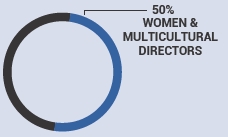

Our Commitment to Diversity and Inclusion Drives Progress across the Organization.The strength of our |

Pay for Performance

In determining compensation for our named executive officers for performance in fiscal 2016, Omnicom again demonstrated its commitment to closely link executive compensation to performancefostering a culture of diversity and inclusion at every level of our organization is demonstrated by makingthe diversity on our Board. At the Board level, a significant portionmajority of potential compensation variable, as well as long-term performance driven.our directors are female, four directors are African American, and three of our four committees are chaired by female directors. We believe this is alignedthe diversity of our Board, together with shareholder intereststhe many ongoing initiatives across our organization and the long-term interests of the Company. In our Compensation Discussion & Analysis,progress we have endeavored to continue enhancing our compensation disclosure to explain clearly our compensation program includingmade on diversity throughout Omnicom, reflects the variousfact that diversity and inclusion are core Omnicom values and essential components of pay, selectionour culture. A diverse workforce supports the success of metrics, balance between long-termour business as it creates a robust mix of viewpoints and short-term awards and strong pay-for-performance alignment.

The Board remains focused on its oversight responsibility and will continueideas that enhance our ability to communicate its efforts to shareholders. We believe that regular, transparent communication with our shareholders is criticaldeliver superior services to our long-term success.clients.

I have shared with you before that it is a privilege to serve as Omnicom’s Lead Independent Director, and that sentiment holds true today. On behalf of the entire Board, I thank you for your support and look forward to continuing a constructive dialogue in the years to come.work with our management team to navigate present challenges and create sustainable, long-term value for you, our shareholders.

Leonard S. Coleman, Jr.

Lead Independent Director

|

|

www.omnicomgroup.com 3

OMNICOM GROUP INC.437 Madison AvenueNew York, New York 10022Subject:

| 1. | Elect the directors named in the Proxy Statement accompanying this notice to the Company’s Board of Directors to serve until the Company’s | |

| 2. | Vote on an advisory resolution to approve executive compensation. | |

| 3. | ||

| Ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, | ||

| 4. | Vote on the shareholder proposal described in the accompanying Proxy Statement, if properly presented at the 2020 Annual Meeting of Shareholders. | |

The Board unanimously recommends that you vote:

| ■ | ||

| ||

FOReach of the director nominees; | ||

| ■ | ||

FORthe advisory resolution to approve executive compensation; | ||

| ■ | ||

| ||

FORthe ratification of the appointment of KPMG LLP as our independent | ||

| ■ | ||

|

| |

Shareholders will also transact any other business that is properly presented at the meeting. At this time, we know of no other matters that will be presented.

In accordance with the rules promulgated by the U.S. Securities and Exchange Commission, we sent a Notice of Internet Availability of Proxy Materials on or about April 13, 2017,29, 2020, and provided access to our proxy materials on the Internet, beginning on April 13, 2017, for29, 2020, to the holders of record and beneficial owners of our common stock as of the close of business on the record date.

Please sign and return your proxy card or vote by telephone or Internet (instructions are on your proxy card), so that your shares will be represented at the 20172020 Annual Meeting of Shareholders, whether or not you plan to attend. For your convenience, you may attend the meeting in person or online through a live audio webcast of the meeting. If you do attend in person, you will be asked to present valid photo identification, such as a driver’s license or passport, before being admitted. Cameras, recording devices and other electronic devices will not be permittedpermitted.

You may also attend the 2020 Annual Meeting online by visiting www.virtualshareholdermeeting.com/OMC2020 and entering the 16-digit control number included on your Notice of Internet Availability of Proxy Materials or proxy card. Shareholders of record that hold shares directly in their own name through our transfer agent, Equiniti Trust Company, or through an Omnicom employee plan, must pre-register to attend the 2020 Annual Meeting online at www.proxypush.com/OMC prior to the meeting.deadline of Tuesday, June 2, 2020 at 5:00 p.m. Eastern Daylight Time. Additional information about the meeting is included below in this Proxy Statement in the section entitled “Information About Voting and the Meeting.”

Michael J. O’Brien

|

New York, New York

April 29, 2020

|

Meeting Date: |

|

Time: |

|

Place: Shareholders may also |

|

Record Date: |

| www.omnicomgroup.com | 3 |

4 Proxy Statement 2017This summary highlights selected information about the items to be voted on at the 2020 Annual Meeting of ShareholdersShareholders. This summary does not contain all of the information that you should consider in deciding how to vote. You should read the entire Proxy Statement carefully before voting.

Meeting Agenda and Voting Recommendations

| ITEM 1: | Election of Directors |

The Board recommends a voteFOReach of the director nominees. ■We have conducted a comprehensive evaluation of director skill sets to ensure that each director's unique qualifications and attributes collectively support the oversight of Omnicom's management. ■Diversity is a core value at every level of our organization. A majority of our director nominees are female and four are African American. The Audit, Compensation and Finance Committees are all Chaired by female directors, and the Chair of the Governance Committee is African American. ■Eight of Omnicom’s nine director nominees are independent, and each of the Audit, Compensation, Governance and Finance Committees is comprised solely of independent directors. ■Each of our directors is elected annually by a majority of votes cast. |  |  See page 10 for further information |

| DIRECTOR NOMINEES |

| Name and Age | Principal Occupation | Director Since | Omnicom Committees | Other Current Public Company Boards | ||||

| Mary C. Choksi, (I), 69 | Former Founding Partner and Senior Manager of Strategic Investment Group | 2011 | A(Chair) C | ■Avis Budget Group ■White Mountains Insurance Group, Ltd. | ||||

| Leonard S. Coleman, Jr. (I), 71 Lead Independent Director | Former President, National League of Professional Baseball Clubs | 1993 | C G(Chair) | ■Avis Budget Group ■Electronic Arts Inc. ■Hess Corporation | ||||

| Susan S. Denison, (I), 74 | Former Partner, Cook Associates | 1997 | C(Chair) G | |||||

| Ronnie S. Hawkins, (I), 51 | Managing Director of Global Infrastructure Partners | 2018 | G F | |||||

| Deborah J. Kissire, (I), 62 | Former Vice Chair and Regional Managing Partner, EY | 2016 | A F | ■Cable One, Inc. ■Axalta Coating Systems Ltd. | ||||

| Gracia C. Martore, (I), 68 | Former President and Chief Executive Officer, TEGNA Inc. | 2017 | A F(Chair) | ■WestRock Company ■United Rentals, Inc. | ||||

| Linda Johnson Rice, (I), 62 | Chairman and Chief Executive Officer, Johnson Publishing Company | 2000 | C G | ■Grubhub Inc. | ||||

| Valerie M. Williams, (I), 63 | Former Southwest Assurance Managing Partner, EY | 2016 | A F | ■WPX Energy, Inc. ■DTE Energy Co. | ||||

| John D. Wren, 67 | Chairman and Chief Executive Officer, Omnicom | 1993 |

| (I):Independent | A:Audit | C:Compensation | F:Finance | G:Governance |

| 4 |  | 2020Proxy Statement |

PROXY SUMMARY

Board Snapshot

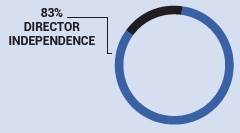

Independence | Diversity | |

8 of 9are independent  | Women & Multicultural Directors  | |

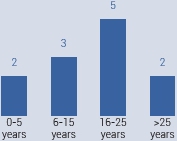

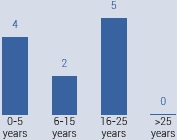

Current Tenure of 2020 Nominees | Experience and Skills | |

|  Our director nominees are accomplished leaders who bring a mix of experiences and skills to the Board. Our director nominees are accomplished leaders who bring a mix of experiences and skills to the Board. Our Board has identified skill categories fundamental to its ability to effectively oversee Omnicom's strategy and management, and undertakes a comprehensive evaluation to ensure these skills are well represented on the Board. Our Board has identified skill categories fundamental to its ability to effectively oversee Omnicom's strategy and management, and undertakes a comprehensive evaluation to ensure these skills are well represented on the Board. See page 11 for further information. See page 11 for further information. |

| GOVERNANCE HIGHLIGHTS |

The Board has adopted, and periodically reviews, policies and procedures to guide it in its oversight responsibilities. These policies and procedures provide a framework for the proper operation of our Company and align with shareholders' interests.

Shareholder Rights | Independent Oversight | Good Governance | ||

Annual election of all directors Annual election of all directors Majority voting standard in uncontested elections Majority voting standard in uncontested elections Proxy access rights consistent with overwhelming market practice Proxy access rights consistent with overwhelming market practice Right to call a special meeting of the Board with 10% ownership threshold Right to call a special meeting of the Board with 10% ownership threshold Continued efforts to foster a successful shareholder outreach program Continued efforts to foster a successful shareholder outreach program |  Engaged Lead Independent Director with clear and robust responsibilities Engaged Lead Independent Director with clear and robust responsibilities All directors are independent except the Chairman, who also serves as CEO All directors are independent except the Chairman, who also serves as CEO Executive sessions of our independent non-management directors are conducted on a regular basis Executive sessions of our independent non-management directors are conducted on a regular basis All Board committees are comprised solely of independent directors All Board committees are comprised solely of independent directors Comprehensive oversight of strategy and risk Comprehensive oversight of strategy and risk |  Annual Board and committee evaluations and skill set assessment Annual Board and committee evaluations and skill set assessment Director orientation and continuing education Director orientation and continuing education Strong equity ownership requirement for executives and directors (3x to 6x base salary for executives; 5x annual cash retainer for directors) Strong equity ownership requirement for executives and directors (3x to 6x base salary for executives; 5x annual cash retainer for directors) Robust processes for confidential and anonymous submission by employees of concerns regarding accounting or auditing matters, as well as potential violations of our Code of Business Conduct or Code of Ethics for Senior Financial Officers Robust processes for confidential and anonymous submission by employees of concerns regarding accounting or auditing matters, as well as potential violations of our Code of Business Conduct or Code of Ethics for Senior Financial Officers |

| www.omnicomgroup.com | 5 |

PROXY SUMMARY

| SHAREHOLDER ENGAGEMENT |

Ongoing shareholder engagement is a priority for our Board and management team. In 2019, we reached out to shareholders holding 68% of our outstanding shares and spoke to shareholders representing 25% of outstanding shares, which was every shareholder who accepted our invitation for engagement. As in prior years, Mr. Coleman, our Lead Independent Director, was an active participant in select shareholder meetings. Broad topics discussed included:

| ■ | Company strategy and performance |

| ■ | Board composition, refreshment and leadership |

| ■ | Management succession |

| ■ | Executive compensation program |

| ■ | Diversity and inclusion efforts across the organization |

| ■ | Governance practices |

| ■ | Sustainability initiatives |

We have made a number of changes in recent years in response to the feedback we have received from our ongoing shareholder engagement efforts, including:

Topics discussed with Shareholders | Recent Board actions in response to feedback | |

Board Leadership– A large majority of our shareholders indicated they are supportive of the combined Chair and CEO positions given our strong Lead Independent Director role, the critical nature of client-chairman relationships in our professional services business, and the complex nature of our rapidly changing industry | ■The role and responsibilities of our Lead Independent Director, which were most recently enhanced in February 2019, are robust and clearly defined ■Based on shareholder feedback, the independent members of the Board elected Mr. Coleman to serve as our new Lead Independent Director in December 2015, and Mr. Coleman has since been re-elected by the independent directors annually ■The Board continues to evaluate its leadership structure on an ongoing basis to ensure its structure is in the best interest of shareholders | |

Board Refreshment– Shareholders are pleased with the level of progress we have shown to meaningfully refresh and further diversify our Board | ■The Board has implemented a thoughtful approach to refreshment, including adoption of a mandatory retirement policy, which fostered a smooth transition ■Since March 2016, the Board has appointed four new independent directors ■Two directors will not stand for re-election at the 2020 Annual Meeting and therefore are not included in this Proxy Statement ■The Board anticipates continued Board refreshment on an ongoing basis | |

Director Skill Sets– Shareholders support the diverse aggregation of skills represented by the members of our Board, and appreciate the deliberate director skill set analysis undertaken by the Board to inform the director recruitment process | ■The Board continues its search for qualified director candidates, with ongoing assistance by a third-party search firm ■The current mix of director skills provides effective oversight of management, with those skill categories with the highest levels of director experience, namely Talent Management, Finance & Accounting, and Risk Management & Controls, aligning with the Company’s top priorities and critical areas of oversight that shareholders expect to see represented on the Board ■The Board conducted a deliberate director skill set analysis and has identified and discussed with shareholders certain director skill categories such as Technology and Legal/Regulatory that it intends to prioritize with respect to prospective director candidates |

We appreciate the insights and perspectives of our shareholders, which were discussed among the full Board.

| 6 |  | 2020Proxy Statement |

PROXY SUMMARY

| ITEM 2: | Advisory Resolution to Approve Executive Compensation |

The Board recommends a vote FOR this voting item. ■We closely tie pay to current and long-term Company performance; ■We maintain a high degree of variable, “at-risk” compensation; ■We establish challenging performance metrics that align with our business strategy; and ■We sustain competitive compensation levels. |  |  See page 33 for further information |

| EXECUTIVE COMPENSATION HIGHLIGHTS |

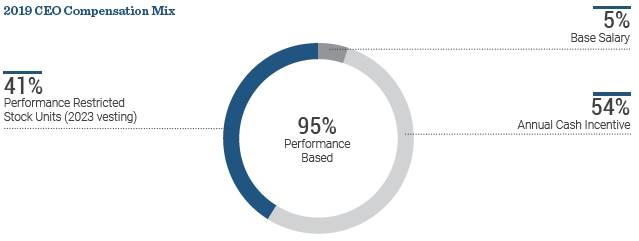

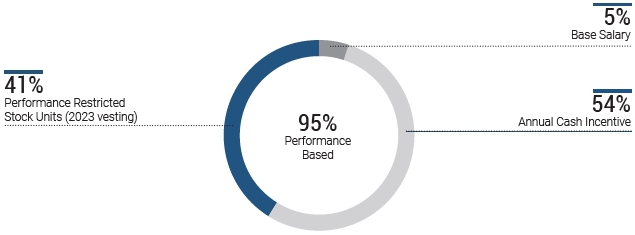

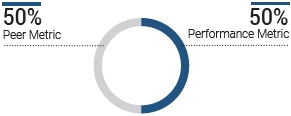

Omnicom strives to closely link executive compensation to performance by making a significant portion of potential compensation variable, or “at-risk” as well as long-term performance driven. In 2019, we compensated our CEO using the following elements for total target direct compensation.

95%of our CEO’s 2019 compensation was variable and based on performance

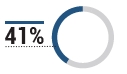

| The Incentive Award, based on quantitative performance measures, is allocated between short-term cash and long-term equity-based awards; for our CEO and CFO, Performance Restricted Stock Units (the “PRSUs”) are subject to further performance conditions over a three-year period from 2020 to 2022. | 41%of our CEO’s 2019 compensation was also contingent upon the future performance of the Company. | |||||||

| |

| Emphasis on performance-based compensation |

| Executive and director stock ownership guidelines (6x base salary for CEO; 3x base salary for CFO) |

| Policy adopting equity grant best practices |

| Compensation forfeiture/clawback policy |

| Policy prohibiting hedging of company equity securities |

| Policy prohibiting pledging and margin transactions |

| www.omnicomgroup.com | 7 |

PROXY SUMMARY

| ITEM 3: | Ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending December 31, 2020 |

The Board recommends a voteFOR this voting item. |  |  See page 66 for further information |

| ITEM 4: | Shareholder Proposal Regarding Proxy Access Amendment |

The Board recommends a voteAGAINST this voting item. |  |  See page 68 for further information |

| 8 |  | 2020Proxy Statement |

www.omnicomgroup.com 5

OMNICOM GROUP INC.437 Madison AvenueNew York, New York 10022

PROXY STATEMENT

| www.omnicomgroup.com | |

ITEM 1 — ELECTION OF DIRECTORS

______________

Omnicom Board Compositionof Directors

The Board of Directors of Omnicom Group Inc., a New York corporation (“Omnicom,” the “Company,” “we,” “us” or “our”), currently consists of 1311 directors: 1110 independent directors, Bruce Crawford, our Chairman of the Board, and John D. Wren, our PresidentChairman and Chief Executive Officer. Each director stands for election annually and is elected by a majority of votes cast (in an uncontested election). Our Board values the views of our investors regarding board composition and, in response to investor input, has made board refreshment a priority. As part of this ongoing board refreshment process:

| Deborah J. Kissire, a former Vice Chair and Regional Managing Partner of EY, joined our Board and Audit Committee in March 2016 and Finance Committee in May 2017. |

| Valerie M. Williams, a former Southwest Assurance Managing Partner for EY, joined our Board in October 2016, Audit Committee in December 2016 and Finance Committee in December 2017. |

| Gracia C. Martore, the former President and Chief Executive Officer of TEGNA Inc., joined our Board and Audit Committee in July 2017, joined the Finance Committee in May 2019 and became Chair of the Finance Committee in March 2020. |

| Ronnie S. Hawkins, a Managing Director of Global Infrastructure Partners, joined our Board and Finance Committee in February 2018 and Governance Committee in February 2019. |

| ■ | Pursuant to the Board’s mandatory retirement age policy, two independent Board members will not stand for re-election at our |

As a result of these changes to our Board’s composition, we expect that following the 2017 Annual Meeting, our Board will consist of 12 directors, 10 of whom will be independent. We anticipate continued refreshment of our Board over the next couple of yearsrefreshment and remain focused on ensuring a smooth transition. Director biographiestransition and information about the committees on which our directors serve is included below in the section entitled “Item 1 — Election of Directors.”onboarding process for new directors.

|  | |||

| DIRECTOR TENURE | ||||

6 Proxy Statement 2017 Annual MeetingA balanced mix of Shareholders

Tablefresh perspectives and institutional knowledge enables strong Board oversight of Contents

Corporate Governance

We are strongly committed to shareholder outreach, supportedmanagement. The 2020 director tenure chart below illustrates this balance and overseen byreflects the Board, and believe regular, transparent communication with our shareholders is important to our long-term success. Duringmeaningful board refreshment that has been underway over the last year, we have reached out to shareholders representing 68%several years.

Current Tenure of our outstanding shares and engaged with 35% in a continued effort to foster a successful shareholder outreach program, establishing and deepening the relationships with the governance teams at many of our largest investors. Mr. Coleman, our Lead Independent Director, actively participates in selected investor meetings each year. To ensure that we fully address any shareholder concerns, shareholder feedback is shared with the Governance and Compensation Committees, as appropriate, as well as with the full Board.2020 Nominees

In response to conversations we have had with our shareholders, we have made the following significant corporate governance enhancements over the past year:

| ||

Based on the feedback we received from shareholders, the Board has taken significant steps to be responsive to their concerns, including adoption of a board retirement policy described in the section entitled “Director Retirement Policy” on page 11 that by the 2018 Annual Meeting of Shareholders will have resulted in six of our Board members stepping down between May of 2016 and May of 2018. We value our investors’ views regarding our Company, as well as their opinions on corporate governance best practices. Our Board and management found this engagement constructive and informative and will continue our engagement efforts.

Lead Independent Director

Our Board is committed to improving the Company’s corporate governance practices, and we have significantly enhanced the responsibilities of our Lead Independent Director to strengthen the Board’s independent oversight of management. Further, we have formalized the annual process whereby our independent directors elect the Company’s Lead Independent Director. This individual would typically also serve as a member of the Governance Committee and, as such, participate in directorand CEO succession planning. In addition to the responsibilities of all directors, our Lead Independent Director’s other duties, which the Board continues to evaluate through engagement with shareholders, are:

www.omnicomgroup.com 7

Corporate GovernanceITEM 1 — ELECTION OF DIRECTORS

In May 2016, the independent members of our Board re-elected Leonard S. Coleman, Jr. to serve as the Company’s LeadIndependent Director. During his tenure as a member of the Board, Mr. Coleman has consistently demonstrated thoughtful leadership and intelligent decision making. Each year in which he has served as Lead Independent Director, Mr. Coleman has committed to being personally involved in our shareholder engagement efforts. Mr. Coleman’s proven integrity and values align perfectly with the important role of Lead Independent Director. Coupled with his extensive senior management, financial, government, development and public company board experience, the independent members of the Board determined that Mr. Coleman would be the ideal candidate to serve as the Company’s Lead Independent Director. We believe that this leadership structure enhances the accountability of the CEO to the Board and strengthens the Board’s independence from management.

Chairman and CEO Roles

Our Board understands that there are differing views on the most appropriate Board leadership structure depending on a company’s specific characteristics and circumstances. We currently maintain separate Chairman of the Board and CEO roles. The CEO is responsible for the overall execution of the Company’s strategy and maintains vital relationships with hundreds of our top clients and key employees. The Chairman of the Board provides guidance and mentorship to the CEO and presides over meetings of the full Board. Our Governance Committee, as well as the full Board when appropriate, regularly evaluates the leadership structure of our Board to determine what works best for the Company and whether combining the roles of Chairman and CEO or keeping them separate best serves the interests of our shareholders. Whether the roles of Chairman and CEO are separate or combined, we will continue to have a Lead Independent Director to ensure independent oversight of our Board.

Our Chairman of the Board, Bruce Crawford, has tremendous experience both with Omnicom and in the advertising, marketing and corporate communications industries. He began his career in advertising in 1956 and, in 1963, he joined BBDO Worldwide, an Omnicom company. He held a variety of high-level positions at BBDO, including that of President and CEO. He was Omnicom’s President and CEO from 1989 until 1995, when he became Omnicom’s Chairman of the Board and CEO. Upon Mr. Wren’s appointment as President and Chief Executive Officer in 1997, Mr. Crawford resigned from his role as CEO, while remaining Chairman of the Board, as well as an executive officer. Our Board has determined that Mr. Crawford’s continued role as Chairman of the Board allows us to further benefit from the depth of Mr. Crawford’s prior experience and helps us preserve our distinctive culture and history.

Our Board believes that the current Board leadership structure is best for the Company and its shareholders at this time.

Director Independence

Our outside directors are Alan R. Batkin, Mary C. Choksi, Robert Charles Clark, Leonard S. Coleman, Jr., Susan S. Denison, Michael A. Henning, Deborah J. Kissire, John R. Murphy, John R. Purcell, Linda Johnson Rice and Valerie M. Williams. Our Board has determined that all of our outside directors are “independent” within the meaning of the rules of the New York Stock Exchange (“NYSE”), as well as under our Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our website at http://www.omnicomgroup.com. In determining that each of our outside directors is independent, the Board took into consideration the answers to annual questionnaires completed by each of the directors, which covered any transactions with director-affiliated entities. The Board also considered that Omnicom and its subsidiariesoccasionally and in the ordinary course of business, sell products and services to, and/or purchase products and services from, entities (including charitable foundations) with which certain directors are affiliated. The Board determined that these transactions were not material to Omnicom or the entity and that none of our directors had a material interest in the transactions with these entities. The Board therefore determined that none of these relationships impaired the independence of any outside director.

As a matter of policy, the independent, non-management directors regularly meet in executive session, without management present. The independent directors met six times in 2016. Mr. Coleman, our Lead Independent Director, presides over executive sessions of the Board.

8 Proxy Statement 2017 Annual Meeting of Shareholders

Corporate Governance

Board Operations and Committee Structure

Our Board met nine times during 2016. The Board generally conducts specific oversight tasks through committees so that the Board as a whole can focus on strategic matters and those particular tasks that by law or custom require the attention of the full Board. Our Board has established five standing committees, functioning in these areas, as explained more fully below:

Each of the committees operates under a written charter recommended by the Governance Committee and approved by the Board. The Board operates pursuant to our Corporate Governance Guidelines. Each Board committee is authorized to retain its own outside advisors. Our Corporate Governance Guidelines and committee charters, which have been approved by the Board, are posted on our website at http://www.omnicomgroup.com. The table below provides current membership for each Board committee.

Committees of the Board of Directors

| Director | Audit | Compensation | Governance | Finance | Executive | |||||||||||||||

| Alan R. Batkin | ■ | ■ | ||||||||||||||||||

| Mary C. Choksi | ■ | ■ | ||||||||||||||||||

| Robert Charles Clark | ■ | ■ | ||||||||||||||||||

| Leonard S. Coleman, Jr. | ■ | ■ | ■ | |||||||||||||||||

| Bruce Crawford | ■ | ■ | ||||||||||||||||||

| Susan S. Denison | ■ | ■ | ||||||||||||||||||

| Michael A. Henning | ■ | ■ | ||||||||||||||||||

| Deborah J. Kissire | ■ | |||||||||||||||||||

| John R. Murphy | ■ | ■ | ■ | |||||||||||||||||

| John R. Purcell | ■ | ■ | ■ | |||||||||||||||||

| Linda Johnson Rice | ■ | ■ | ||||||||||||||||||

| Valerie M. Williams | ■ | |||||||||||||||||||

| John D. Wren | ||||||||||||||||||||

| Number of Meetings in 2016 | 11 | 9 | 9 | 7 | 1 | |||||||||||||||

Audit Committee:The Audit Committee’s purpose is to assist the Board in carrying out its financial reporting and oversight responsibilities, including oversight of risk as described in “Risk Oversight” below. In this regard, the Audit Committee assists the Board in its oversight of (a) the integrity of our financial statements, (b) compliance with legal and regulatory requirements, (c) the qualifications and independence of our independent auditors, and (d) the performance of our internal audit function and independent auditors. Furthermore, the Audit Committee prepares the report included below in the section entitled “Audit Committee Report.” The Audit Committee also has the power to retain or dismiss our independent auditors and to approve their compensation.

The Board has determined that each member of our Audit Committee is “independent” within the meaning of the rules of both the NYSE and Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has also determined that each member of our Audit Committee is an “audit committee financial expert,” is “financially literate” andhas “accounting or related financial management expertise,” as such qualifications are defined by U.S. Securities and Exchange Commission (“SEC”) regulations and the rules of the NYSE, respectively.

Compensation Committee:The Compensation Committee’s purpose is (a) to assist the Board in carrying out its oversight responsibilities relating to compensation matters, including oversight of risk as described in “Risk Oversight” below, (b) to prepare a report on executive compensation for inclusion in our annual Proxy Statement and (c) to administer and approve awards under our equity and other compensation plans. The report of the Compensation Committee is included below in the section entitled “Compensation Committee Report.”

The Board has determined that each member of our Compensation Committee is “independent” within the meaning of the rules of the NYSE, a “non-employee director” within the meaning of the regulations of the SEC and an “outside director” within the meaning of regulations of the U.S. Treasury.

www.omnicomgroup.com 9

Corporate Governance

Governance Committee:The Governance Committee’s purpose is to assist the Board in carrying out its oversight responsibilities, including oversight of risk as described in “Risk Oversight” below, relating to (a) the composition of the Board and (b) certain corporate governance matters. As part of its responsibilities, the Governance Committee considers and makes recommendations to the full Board with respect to the following matters:

The Governance Committee also oversees our shareholder engagement efforts and periodically receives reports from management on shareholder feedback. The Board has determined that each member of our Governance Committee is “independent” within the meaning of the rules of the NYSE.

Finance Committee:The Finance Committee’s purpose is to assist the Board in carrying out its oversight responsibilities relating to financial matters affecting Omnicom, including in respect of acquisitions, divestitures and financings and the oversight of risk as described in “Risk Oversight” below.

Executive Committee:The Executive Committee’s purpose is to act on behalf of the Board in the management of the Board’s business and affairs between Board meetings, except as specifically prohibited by applicable law or regulation, or by our charter or By-laws.

Nominations for directors at our 2018 Annual Meeting of Shareholders may be made only by the Board, or by a shareholder entitled to do so pursuant to our By-laws not later than the deadlines set forth below in the section entitled “Shareholder Proposals and Director Nominations for the 2018 Annual Meeting.”

Our By-laws provide that shareholders may present director nominations directly at the annual meeting (and not for inclusion in our proxy statement) by satisfying certain advance notice requirements, and providing information as to such nominee and submitting shareholder as specified in our By-laws. Our By-laws also permit a shareholder or group of up to 20 shareholders owning 3% or more of the Company’s common stock continuously for at least three years to nominate and include in the Company’s proxy statement director candidates constituting up to 20% of the Board, but no less than two, to be considered for election by the holders of the Company’s common stock, provided that the shareholder (or group) and each nominee satisfy the requirements and provide information as to such nominee and submitting shareholder as specified in our By-laws.

You can obtain a copy of the full text of the By-law provisions noted above by writing to our Corporate Secretary at our address listed below in the section entitled “Availability of Certain Documents”, or on our website at http://www.omnicomgroup.com. Our By-laws have also been filed with the SEC.

The Governance Committee will consider all candidates recommended by our shareholders in accordance with the procedures included in our By-laws and this Proxy Statement. We did not receive any nominee recommendations from shareholders this year. Any future director candidate recommendations made by shareholders that are properly submitted will be considered by the Governance Committee in the same manner as those submitted by the Board or the Governance Committee itself.

Our Board seeks to ensure that it is composed of individuals not only with substantial experience and judgment but also from diverse backgrounds and experiences. In determining the nominees for the Board, our Governance Committee considers the criteria outlined in our Corporate Governance Guidelines including a nominee’s independence, his or her background and experience in relation to other members of the Board, and his or her readinessability to commit the time and focus required to discharge Board duties and independence issues.duties. In addition, our Governance Committee considers the composition of the Board as a whole and diversity in its broadest sense, including persons diverse in gender ethnicity and geographyethnicity as well as representing diversediversity of viewpoints, ages, and professional and life experiences. In considering diversity, director nominees are neither chosen nor excluded solely or largely based on any one factor. The Governance Committee considers a broad spectrum of skills and experience to ensure a strong and effective Board.

Board and Committee Evaluation Processnominees are neither chosen nor excluded solely or largely based on any one factor.

Every year, theOur Board and its committees each conduct a self-evaluationseeks to align our directors’ collective expertise with those areas most important to strong oversight of management at Omnicom. Accordingly, we periodically evaluate Board composition to help inform Board succession planning efforts, maintain close alignment between Board skills and Omnicom’s long-term strategy, and promote Board and committee effectiveness. The Governance Committee leads the evaluation process, which is overseen by our Lead Independent Director. The process allows directors to evaluate the Board asWe have implemented a whole and the standing committees of the Board on which each director serves through questionnaires covering topics such as:

10 Proxy Statement 2017 Annual Meeting of Shareholders

Corporate Governance

Our Governance Committee recommends to the full Board a planrigorous skills analysis for any changes to the functions of our Board or its committees including on structure, responsibilities, performance and composition.

The Governance Committee reviews the composition of the Board and recommends to the full Board nominees for election. The Governance Committee identifies the skills and experienceneeded to replace any departing director and performs research, either itself or by engaging third parties to do so on its behalf, to identify and evaluate director candidates.

Attendance at Board and committee meetings during 2016 averaged close to 100% for the directors as a group. Except for a director who missed two meetings and had a 93% attendance record, each of our other directors attended 100%and have found that those skill categories with the highest aggregate level of director experience, namely Talent Management, Finance & Accounting, and Risk Management & Controls, align with the meetings ofareas most critical to Board oversight at Omnicom. The chart below outlines the Boardskill and the committees of the Board on which he or she served during 2016. We encourage our directors to attend our annual meetings of shareholders, and all of our directors attended the 2016 Annual Meeting of Shareholders.

In December 2015, the Board adopted a mandatory retirement age policy for directors. The policy provides that, effective December 31, 2017, no director shall be nominated for election or re-election to the Board if the director has reached 75 years of age on or before December 31st of the year preceding election or re-election. The Board, upon the recommendationof the Governance Committee, may waive this limitation for any director if the Board determines that it is in the best interests of the Company and its shareholders to extend the director’s service. In the event of a waiver, the Board will provide shareholders with rationale for its decision.

Compensation Committee Interlocks and Insider Participation

The following directors served as members of our Compensation Committee during all or a portion of 2016: Susan S. Denison, Alan R. Batkin, Mary C. Choksi, Leonard S. Coleman, Jr., Michael A. Henning, Linda Johnson Rice and Gary L. Roubos. None of the Compensation Committee members serving during 2016 is a current or former employee or officer of Omnicom or its subsidiaries. None of the Compensation Committee membersserving during 2016 has ever had any relationship requiring disclosure by Omnicom under Item 404 of Regulation S-K. During 2016, none of our executive officers served as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any other company that had an executive officer serving as a member ofexperience categories our Board or its Compensation Committee.

Qualifications of the Members of the Board of Directors

In accordance with the process for the selection and nomination of directors described above, the Governance Committee reviews the composition of the Board at least annually and recommends to the full Board nominees for election. As part of its evaluation, the Governance Committee considers the slate of directors as a wholeperiodically evaluates, as well as the specific skills, backgrounds,experiences and qualificationsimportance of each nominee. Thecategory to overall Board believes that a combination of skill-sets and experiences in a variety of industries provides the Board with the necessary range and depth of knowledge to most effectively oversee a company as large and complex as Omnicom.

Omnicom believes that workplace diversity creates value for the Company, enhances the quality of work we create for clients and fosters a positive corporate culture. We know that a workforce reflecting the demographics of our society is better poised to create effective campaigns for our clients that resonate with a diverse population. With our global presence, we believe it is important that our workforce reflects our global community. This commitment to diversity starts within the boardroom. Our Board includes five women and three African Americans, including Leonard S. Coleman, Jr., our Lead Independent Director. Across the Company, we are committed to recruiting and retainingthe best talent from diverse backgrounds, experiences and perspectives and have implemented key programs and initiatives to ensure we deliver on this commitment. These efforts include:effectiveness.

Management & Controls |  |

|

www.omnicomgroup.com 11

Corporate Governance

| ||

| Finance & Accounting |  |

|

Management |  | Our ability to attract and retain the most talented professionals is fundamental to the success of |

| Strategic Planning |  | Our Board’s ability to effectively review and assess the |

| Industry Experience |  | Directors with experience relevant to our industry are |

| CEO Experience |  |

|

|

We have been publicly recognized for our commitment to inclusion and diversity initiatives. Most recently, in 2016 Omnicom was designated as one of the “Best Places to Work forLGBT Equality” by the Human Rights Campaign Foundation and received a score of 100 percent on the foundation’s Corporate Equality Index survey. Our Senior Vice President and Chief Diversity Officer was recognized as the 2015 Global Diversity Champion by the European Diversity Awards. Our Chief Executive Officer, John Wren, was honored as a pioneer and supporter of diversity by the American Advertising Federation at their 2013 Diversity Achievement and Mosaic Awards, and Omnicom Group was recognized as a Diversity Pioneer at the 2012 Diversity Achievement and Mosaic Awards.

Omnicom shares the following key diversity statistics on its website:

| |

| |

| |

| |

|

We believe that these statistics clearly reflect the value Omnicom places on workplace diversity and the strength of its efforts to promote professional opportunities for women and minorities.

Our Board oversees an enterprise-wide approach to risk management, designed to support the achievement of organizational objectives, including strategic objectives, to improve long-term organizational performance and enhance shareholder value. The principal oversight function of the Board and its committees includes understanding the material risks the Company confronts and methods to mitigate or manage those risks. Management is responsible for establishing our business strategy, identifying and assessing the related risks and establishing appropriate risk management practices. Our Board reviews our business strategy and management’s assessment of the related risk, and discusses with management the appropriate level of risk for the Company.

Our Board administers its risk oversight function with respect to our operating risk as a whole, and the Board and its committees meet with management at least quarterly to receive updates with respect to our business operations and strategies, financial results and the monitoring of related risks. The Board also delegates oversight to the Audit, Governance, Compensation and Finance Committees to oversee selected elements of risk:

| |

|

12 Proxy Statement 2017 Annual Meeting of Shareholders

Corporate Governance

| |

|

The Company’s management is responsible for day-to-day risk management. The CEO, CFO and General Counsel periodically report on the Company’s risk management policies and practices to relevant Board committees and to the full Board. Our Treasury, Legal, Controller and Internal Audit functions work with management at the agency level, serving as the primary monitoring and testing function for company-wide policies and procedures, and managing the day-to-day oversight of risk management strategy for the ongoing business of the Company. We believe the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports our approach.

We have a Code of Business Conduct designed to assure that our business is carried out in an honest and ethical way. The Code of Business Conduct applies to all of our, and our majority-owned subsidiaries’, directors, officers and employees and requires that they avoid conflicts of interest, comply with all laws and other legal requirements and otherwise act with integrity. In addition, we have adopted a Code of Ethics for Senior Financial Officers regarding ethical action and integrity relating to financial matters applicable to our senior financial officers. Our Code of Business Conduct and Code of Ethics for Senior Financial Officers are available on our website at http://www.omnicomgroup.com, and are also available in print to any shareholder that requests them. We will disclose any future amendments to, or waivers from, certain provisions of these ethical policies and standards for senior financial officers, executive officers and directors on our website within the time period required by the SEC and the NYSE.

We also have procedures to receive, retain and treat complaints regarding accounting, financial reporting and disclosure, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters, as well as possible violations of our Code of Business Conduct or Code of Ethics for Senior Financial Officers. The procedures are posted on our website at http://www.omnicomgroup.com and the websites of our various global networks.

www.omnicomgroup.com 13

| www.omnicomgroup.com | 11 |

ITEM 1 — ELECTION OF DIRECTORS

| International Business |  | Because of |

| Technology |  | Technological experience enables our directors to provide important insight regarding cybersecurity, data privacy and other matters related to our information security and technology systems as we navigate a time of rapid technological advancement industry-wide. |

| Public Company Board Experience |  | Through their experience serving on the boards of other large publicly traded companies, directors bring a valuable understanding of board functions and effective independent oversight. |

In addition to possessing the skills discussed above, each of our directors must also demonstrate sound judgment, integrity of thought, ethical behavior, critical insight into Omnicom’s businesses, the ability to ask challenging questions of management, and a healthy respect for their fellow Board members.

| 2020 DIRECTOR NOMINEES: 9 TOTAL |

Independence: eight of our director | Diversity: six of our director nominees are | |||

| 89% | 89% | |||

| Director Independence | Women & Multicultural Directors | |||

|  | |||

| 12 |  | 2020Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

| 2020 DIRECTOR NOMINEES |

Of the current 1311 members of the Board, 12nine have been nominated to continue to serve as directors for another year, while one will not stand for re-election in connection with our board refreshment initiative.year. All 12of the director nominees have been recommended for election to the Board by our Governance Committee and approved and nominated for election by the Board. We periodically engage a third-party search firm to assist with the evaluation of director candidates.

The Board has no reason to believe that any of the nominees would be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, the Board may, prior to the meeting, select a substitute nominee or undertake to locate another director after the meeting. If you have submitted a proxy and a substitute nominee is selected, your shares will be voted for the substitute nominee.

In accordance with our By-laws, directors are elected by a majority of the votes cast. That means the nominees will be elected if the number of votes cast “for” a director’s election exceeds the number of votes cast “against” such nominee. For this purpose, broker non-votes will not count as a vote cast and will have no effect on the elections of directors. Our form of proxy permits you to abstain from voting “for” or “against” a particular nominee. However, shares represented by proxies so designated will count as being present for purposes of determining a quorum but will not count as a vote cast and will have no effect on the election of directors. Such proxies may also be voted on other matters, if any, that may be properly presented at the meeting.

If an incumbent nominee is not reelected, New York law provides that the director would continue to serve on the Board as a “holdover director.” Under our By-laws and a policy adopted by the Board, such a director is required to promptly tender his or her resignation to the Board. The Governance Committee of the Board then must consider whether to accept the director’s resignation and make a recommendation to the Board. The Board will then consider the resignation, and within 90 days after the date of certification of the election results, publicly disclose its decision and the reasons for its decision. A director whose resignation is under consideration may not participate in any deliberation regarding his or her resignation unless none of the directors received a majority of the votes cast. If the Board accepts a director’s resignation, the Board will then elect a replacement in accordance with the By-laws.

A balanced mix of fresh perspectives and institutional knowledge enables strong Board oversight of management. The chart below illustrates tenure of the 2017 director nominees and the projected tenure of our directors at the time of our 2018 Annual Meeting. The chart also provides board refreshment highlights that summarize key steps towards meaningful board refreshment.

Director Tenure & Refreshment: Significant Refreshment Underway

| |

| |

| |

| |

14 Proxy Statement 2017 Annual Meeting of Shareholders

Item 1 — Election of Directors

John D. Wren Age | ||

Director since 1993 | PROFESSIONAL EXPERIENCE: Mr. Wren is KEY SKILLS AND QUALIFICATIONS: Through the positions |

www.omnicomgroup.com 15

| www.omnicomgroup.com | 13 |

ItemITEM 1 — Election of DirectorsELECTION OF DIRECTORS

69 Director since 2011 Chair of the | PROFESSIONAL EXPERIENCE: From

|

16 Proxy Statement 2017, Annual Meeting of Shareholders

Item 1 — Election of Directors

|

| |

www.omnicomgroup.com 17

Item 1 — Election of Directors

|

OTHER PUBLIC COMPANY BOARDS: Ms. Choksi is a director and member of the supplier, and a director and Chair of the Finance Committee of White Mountains Insurance Group, Ltd., a company whose principal businesses are conducted through its insurance subsidiaries and other affiliates. KEY SKILLS AND QUALIFICATIONS: With her extensive investment management experience, Ms. Choksi brings to the Board a sophisticated comprehension of the financial matters inherent to running a global business enterprise. It is central to Omnicom’s growth and successful financial performance that the Board of Directors’ knowledge base includes Ms. Choksi’s understanding of the utilization of assets to generate growth. Ms. Choksi was a founding partner and Senior Managing Director of the investment management enterprise Strategic Investment Group and a founder, and, until May 2011, a Managing Director of Emerging Markets Management, which manages portfolios of emerging markets securities, primarily for institutional investors. As such, Ms. Choksi has the highest level of experience managing assets, evaluating investment risk, developing investment strategies and determining the optimal use of corporate assets. In addition, Ms. Choksi’s career includes 10 years of experience at the World Bank, primarily working in the Bank’s development arm focusing on projects in South and Southeast Asia. Through this role, Ms. Choksi acquired a keen appreciation of the many challenges facing a multinational institution as it navigates foreign markets and hones its global investment | |

18 Proxy Statement 2017 Annual Meeting of Shareholders

| 14 |  | 2020Proxy Statement |

ItemITEM 1 — Election of DirectorsELECTION OF DIRECTORS

Coleman, Jr. 71 Director since 1993 Lead Independent Director , Chair of the Governance Committee and Member of the | PROFESSIONAL EXPERIENCE:

|

www.omnicomgroup.com 19

Item 1 — Election of Directors

|

| |

20 Proxy Statement 2017 Annual Meeting of Shareholders

| www.omnicomgroup.com | 15 |

ItemITEM 1 — Election of DirectorsELECTION OF DIRECTORS

Susan S. Denison Age | ||

Director since 1997 Chair of the Compensation Committee and Member of the Governance Committee | PROFESSIONAL EXPERIENCE: Ms. Denison is a former partner of Cook Associates, a retained executive search firm, a position she held from June 2001 to April 2015. Ms. Denison has more than twenty years of senior executive experience within the media, entertainment and consumer products industries. She formerly served as a Partner at TASA Worldwide/Johnson, Smith & Knisely and the Cheyenne Group. She has also served as Executive Vice President, Entertainment and Marketing for Madison Square Garden, Executive Vice President and General Manager at Showtime Networks’ Direct-To-Home Division, Vice President, Marketing for Showtime Networks and Senior Vice President, Revlon. In addition, Ms. Denison previously held marketing positions at Charles of the Ritz, Clairol and Richardson-Vicks. KEY SKILLS AND QUALIFICATIONS: With her many years of experience in media and marketing, including multiple senior management roles for companies as varied as Richardson-Vicks, Clairol, Showtime Networks, Revlon and Madison Square Garden, Ms. Denison provides Omnicom and its Board with a deep understanding of consumer behavior and a strategic vision of the business operations of Omnicom’s agencies. As former Partner of an executive search firm and an executive within the media, entertainment and consumer products industries, Ms. Denison brings to the Board an intimate familiarity with executive compensation practices, as well as an extensive knowledge of complex media strategies, the oversight of management, and consumer market insights. Ms. Denison’s leadership experience as a Partner at Cook Associates where she was involved in executive recruiting of the most senior executives, generally at the “C Suite” level, provides her with unparalleled knowledge of the compensation policies and practices of large public companies. This knowledge is an extremely valuable contribution to her role as Chair of Omnicom’s Compensation Committee and better enables the Board to perform its function of overseeing management retention and succession. Ms. Denison also brings an international perspective to the Board through her prior service on the Board and Compensation Committee of a company listed on the Tel-Aviv Stock Exchange. |

www.omnicomgroup.com 21

Item 1 — Election of Directors

51 Director since 2018 Member of the Governance and Finance Committees | PROFESSIONAL EXPERIENCE: Mr. Hawkins is a Managing Director of Global Infrastructure Partners, a position he has held since April 2018. Global Infrastructure Partners is an infrastructure focused private equity firm with over $72 billion of assets under management. In this role, Mr. Hawkins focuses on international investments primarily in the energy sector. Until April 2018, Mr. Hawkins was a Managing Director, Head of International Investments and member of the Investment Committee of EIG Global Energy Partners, which he joined in 2014. From 2009 to 2013, Mr. Hawkins was an Executive Vice President of General Electric where he led GE Energy’s Global Business Development activities and served as Chair of the GE Energy Investment Committee. Prior to that, Mr. Hawkins spent 19 years as a senior member of the energy investment banking departments at Citigroup and Credit Suisse, completing corporate advisory assignments in over 50 countries, including mergers, acquisitions, divestitures and restructurings. Mr. Hawkins has also led numerous corporate financings for large companies including equity, debt and structured financings. KEY SKILLS AND QUALIFICATIONS: Mr. Hawkins has extensive strategic planning and corporate advisory experience developed over many years of identifying and managing energy investments for EIG Global Energy Partners and, more recently, for Global Infrastructure Partners. With a focus on investments outside of the U.S., Mr. Hawkins possesses an in-depth understanding of the complex regulations governing international business operations and contributes the highest level of international experience to the Board’s mix of skill sets. Mr. Hawkins also served as a senior executive at General Electric for several years where he managed acquisitions, divestitures and joint ventures while leading GE Energy’s Global Business Development activities. Having structured and overseen a great number of business transactions encompassing varied and complex business strategies, Mr. Hawkins has honed an acute understanding of strategic planning, business operations and the role of management. This background and knowledge serves as a key component of the Board’s effective oversight of Omnicom and its management. Having held several senior positions at Citigroup and Credit Suisse leading corporate financings and advising public companies on large transactions, Mr. Hawkins brings valuable investment banking expertise to the Board and the Finance Committee on which he serves. Through his considerable experience advising corporate clients, Mr. Hawkins has developed an expert knowledge of corporate compliance best practices which is additive to his service on the Governance Committee and strengthens its oversight of related risks. The experience gained through advising clients on mergers, acquisitions and other strategic corporate transactions provides Mr. Hawkins with a sophisticated ability to evaluate businesses and discern opportunities for growth that greatly enhances the collective skills of the Board and is particularly valuable to his role as a member of the Finance Committee. |

| 16 |  | 2020Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

Deborah J. Kissire Age62 Director since 2016 Member of the Audit | PROFESSIONAL EXPERIENCE: Ms. Kissire held multiple senior leadership positions at EY during her career from 1979 to 2015, serving most recently as Vice Chair and Regional Managing Partner, member of the Americas Executive Board and member of the Global Practice Group. Other positions held include the U.S. Vice Chair of Sales and Business Development and National Director of Retail and Consumer Products Tax Services. Throughout her career at EY, Ms. Kissire’s leadership skills and vision were leveraged for strategic firm initiatives and programs such as their Partner Advisory Council, Strategy Task Force, Gender Equity Task Force, Vision 2000 Sales Task Force, and global Vision 2020. OTHER PUBLIC COMPANY BOARDS: Ms. Kissire is a director and Chair of the Audit Committee of Cable One, Inc. KEY SKILLS AND QUALIFICATIONS: Ms. Kissire brings several key skills to the Board’s overall mix of knowledge and experience. Throughout a career of 36 years at EY, an internationally recognized accounting firm, Ms. Kissire distinguished herself in a variety of roles. She gained extensive experience serving in senior positions at EY and developed a sophisticated ability to gauge risk in financial, accounting and tax matters. Under Ms. Kissire’s leadership, the size of |

22 Proxy Statement 2017 Annual Meeting of Shareholders

Item 1 — Election of Directors

68 Director since 2017 | PROFESSIONAL EXPERIENCE: Ms. Martore is OTHER PUBLIC COMPANY BOARDS: Ms. Martore is a director, Chair of the last five years. KEY SKILLS AND QUALIFICATIONS: Having served as President and Chief Executive Officer of TEGNA Inc., formerly Gannett Co., one of the nation’s largest local media companies, Ms. Martore brings strong leadership skills, broad strategic vision, financial expertise and proven business acumen to the Board. Ms. Martore’s successful navigation of TEGNA’s strategy through a period of significant technological disruption within its industry strengthens the collective oversight function of Omnicom’s Board as it assesses risk and evaluates strategies regarding technological advances implemented by our agencies. Under her leadership, TEGNA doubled its broadcast portfolio and acquired full ownership of Cars.com. Ms. Martore’s experience |

www.omnicomgroup.com 23

| www.omnicomgroup.com | 17 |

ItemITEM 1 — Election of DirectorsELECTION OF DIRECTORS

Johnson Rice 62 Director since 2000 | PROFESSIONAL EXPERIENCE: Ms. Rice is Chairman and Chief Executive Officer of

|

24 Proxy Statement 2017 Annual Meeting of Shareholders

Item 1 — Election of Directors

|

to 2019. Johnson Publishing Company filed a voluntary petition for bankruptcy under Chapter 7 of the U.S. Bankruptcy Code on April 9, 2019. OTHER PUBLIC COMPANY BOARDS: Ms. KEY SKILLS AND QUALIFICATIONS: Ms. | |

www.omnicomgroup.com 25

Item 1 — Election of Directors

Valerie M. Williams Age | ||

Director since 2016 Member of the Audit Finance Committees | PROFESSIONAL EXPERIENCE: Ms. Williams is a former Southwest Assurance Managing OTHER PUBLIC COMPANY BOARDS: Ms. Williams is a director and member of the Audit Committee of WPX Energy, Inc., an independent oil and natural gas exploration and production company engaged in the exploitation and development of long-life unconventional properties, and a director, Chair of the Audit Committee and member of the Corporate Governance Committee of DTE Energy Co., a diversified energy company involved in the development and management of energy-related businesses and services. KEY SKILLS AND QUALIFICATIONS: Ms. Williams has |

| 2020Proxy Statement |

ITEM 1 — ELECTION OF DIRECTORS

| DIRECTOR INDEPENDENCE |

26 Proxy Statement 2017Our outside directors, including those not nominated for re-election, are Alan R. Batkin, Mary C. Choksi, Robert Charles Clark, Leonard S. Coleman, Jr., Susan S. Denison, Ronnie S. Hawkins, Deborah J. Kissire, Gracia C. Martore, Linda Johnson Rice and Valerie M. Williams. Our Board has determined that all of our outside directors are “independent” within the meaning of the rules of the New York Stock Exchange (“NYSE”), as well as under our Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our website at http://www.omnicomgroup.com. In determining that each of our outside directors is independent, the Board took into consideration the answers to annual questionnaires completed by each of the directors, which covered any transactions with director-affiliated entities. The Board also considered that Omnicom and its subsidiaries occasionally and in the ordinary course of business, sell products and services to, and/or purchase products and services from, entities (including charitable foundations) with which certain directors are affiliated. The Board determined that these transactions were not material to Omnicom or the entity and that none of our directors had a material interest in the transactions with these entities. The Board therefore determined that none of these relationships impaired the independence of any outside director. John D. Wren, our Chairman and Chief Executive Officer, is not independent due to his position as an executive officer.

| SHAREHOLDER NOMINATION PROCESS |

Nominations for directors at our 2021 Annual Meeting of Shareholders

may be made only by the Board, or by a shareholder entitled to do so pursuant to our By-laws not later than the deadlines set forth on page 77 in the section entitled “Shareholder Proposals and Director Nominations for the 2021 Annual Meeting.”Our By-laws provide that shareholders may present director nominations directly at the annual meeting (and not for inclusion in our proxy statement) by satisfying certain advance notice requirements, and providing information as to such nominee and submitting shareholder as specified in our By-laws. Our By-laws also permit a shareholder or group of up to 20 shareholders owning 3% or more of the Company’s common stock continuously for at least three years to nominate and include in the Company’s proxy statement director candidates constituting up to 20% of the Board, but no less than two, to be considered for election by the holders of the Company’s common stock, provided that the shareholder (or group) and each nominee satisfy the requirements and provide information as to such nominee and submitting shareholder as specified in our By-laws.

You can obtain a copy of the full text of the By-law provisions noted above by writing to our Corporate Secretary at our address listed below in the section entitled “Availability of Certain Documents,” or on our website at http://www.omnicomgroup.com. Our By-laws have also been filed with the U.S. Securities and Exchange Commission (“SEC”).

The Governance Committee will consider all candidates recommended by our shareholders in accordance with the procedures included in our By-laws and this Proxy Statement. We did not receive any nominee recommendations from shareholders this year. Any future director candidate recommendations made by shareholders that are properly submitted will be considered by the Governance Committee in the same manner as those submitted by the Board or the Governance Committee itself.

| www.omnicomgroup.com | 19 |

ITEM 1 — ELECTION OF DIRECTORS

| MAJORITY VOTING STANDARD FOR ELECTION OF DIRECTORS |

In accordance with our By-laws, directors are elected by a majority of the votes cast. That means the nominees will be elected if the number of votes cast “for” a director’s election exceeds the number of votes cast “against” such nominee. For this purpose, broker non-votes will not count as a vote cast and will have no effect on the elections of directors. Our form of proxy permits you to abstain from voting “for” or “against” a particular nominee. However, shares represented by proxies so designated will count as being present for purposes of determining a quorum but will not count as a vote cast and will have no effect on the election of directors. Such proxies may also be voted on other matters, if any, that may be properly presented at the meeting.

If an incumbent nominee is not re-elected, New York law provides that the director would continue to serve on the Board as a “holdover director.” Under our By-laws and a policy adopted by the Board, such a director is required to promptly tender his or her resignation to the Board. The Governance Committee of the Board must then consider whether to accept the director’s resignation and make a recommendation to the Board. The Board will then consider the resignation, and within 90 days after the date of certification of the election results, publicly disclose its decision and the reasons for its decision.

A director whose resignation is under consideration may not participate in any deliberation regarding his or her resignation unless none of the directors received a majority of the votes cast. If the Board accepts a director’s resignation, the Board will then elect a replacement in accordance with the By-laws.

Board’s Role and Responsibilities

| STRATEGIC OVERSIGHT |

The Board oversees Omnicom’s strategy setting and review process, which is led by the Company’s management team and is focused on execution of a long-term strategy to deliver value to our shareholders. The Board reviews and assesses the strategic priorities developed and implemented by management under the direction of Omnicom’s Chairman and CEO, John Wren. The Board reviews Omnicom’s financial performance throughout the year and evaluates strategy in light of results, with an industry focus that includes peer comparisons and our competitive ability to attract and retain the most talented workforce. At least annually, the Board has a more detailed discussion, generally over two days, which is informed by reports from management on a variety of strategic matters and input regarding strategic goals of Omnicom’s networks and practice areas. At this meeting, the Board receives a complete analysis of the strategies with respect to the multiple business components integral to Omnicom’s comprehensive long-term strategic direction. This meeting also includes management presentations on important topics such as risk management, diversity and inclusion, information technology, cybersecurity and our data breach incident plan, human capital management, and top clients. Our Board believes this comprehensive process greatly strengthens its ability to effectively oversee management as Mr. Wren and senior leadership drive the future success of our Company.

| RISK OVERSIGHT |